Whether you’re a seasoned investor who’s closely observed the financial markets for a number of years or a relative newcomer simply looking to find your way, stock volatility the likes of which we’re witnessing today can be difficult to stomach. Indeed, watching the value of one’s investment portfolio rise and fall with stock prices—sometimes on a daily and hourly basis—can elicit an emotional response from even the most steadfast among us. But allowing short-term market movements to dictate your investment decisions could set you back and derail the long-term goals you’ve defined for yourself.

While the jury’s still out on whether today’s conditions constitute a true economic recession, there’s no denying that we’re in the midst of a full-fledged bear market. The past nine months have seen all three major market indices venture deep into correction territory, with the tech-heavy Nasdaq Composite taking the biggest hit of all, shedding over 32% since the start of 2022.

But despite all the doom and gloom that’s dominated the news cycle of late, there’s nothing inherently wrong with falling stock prices. On the contrary, these stretches of prolonged decline are to be expected. An analysis of historical market trends indicates that staying invested through these periods of decline, as opposed to selling off your assets in a fire sale, often leads to better returns in the long run. Let’s take a closer look at some of these trends.

Stocks Tend to Bounce Back

A bear market is frequently defined as a loss of 20% or more by a broad market index like the S&P 500, Nasdaq, or Dow Jones relative to its most recent peak. By this definition, one occurs about every 56 months and they vary widely in terms of depth and duration. Some bear markets are worse than others, such as the Great Recession of 2008. And some bear markets last longer than others. The bursting of the dot-com bubble precipitated a bear market that took almost two years to resolve, but other bear markets have come and gone in as little as a month.

Regardless of how extreme or prolonged the decline is, the market has historically been able to rebound from it. What’s more, stock prices don’t just tend to recover from these down periods—they bounce back in a big way, usually surpassing their previous highs and setting new ones.

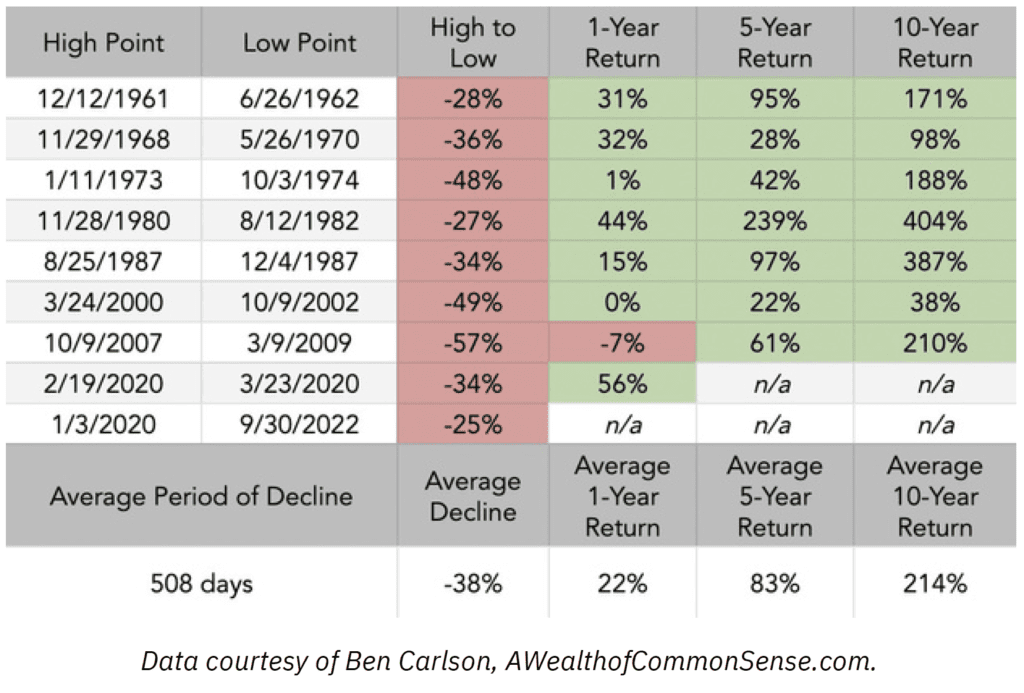

The S&P 500 Index tracks the stock prices of the largest American corporations—the so-called “mega-cap” stocks like Apple, Walmart, and McDonald’s—and therefore gets used by economists and market observers to achieve a snapshot of the US economy as a whole. The table below shows the 1-year, 5-year, and 10-year returns of the S&P 500 Index following a drop of 25% or more. That’s 5% more decline than the established threshold for a bear market.

Since the index was established in 1957, the S&P 500 has declined by at least 25% on only nine occasions. In each instance, it recovered and reached new highs in five years or fewer, averaging an 83% return over that five-year stretch. Over ten years, those returns doubled or even tripled, illustrating the kind of growth investors can capture simply by staying invested.

It’s Often Darkest Just Before the Dawn

In addition to bouncing back in the mid-to-long term, stocks have also shown a tendency to bounce back from price swings in the short term. It’s not uncommon for the S&P 500 to fluctuate several percentage points overnight or in the course of a single day. While institutional traders and market insiders may look to capitalize on these fluctuations to lock in profits, stock trading is not to be confused with investing. Put simply, investors and traders have different goals. Investing is about playing the long game in order to grow your wealth over time without taking on undue risk. Trading, on the other hand, is a short game that involves leveraging market data to generate returns on a weekly, daily, or even hourly basis. In other words, trading is about timing the market while investing is about using time to your advantage.

Without access to the necessary resources and expertise, attempts among retail investors to “time the market” can prove exceedingly difficult. Trying to predict when a stock price will bottom out might lead you to sell assets, even when staying the course (or acquiring more assets) is the stronger long-term option. Instead of achieving the desired result of capitalizing on short-term price movements, investors can end up missing out on some of the market’s best-performing days, which often occur on the heels of its biggest losses.

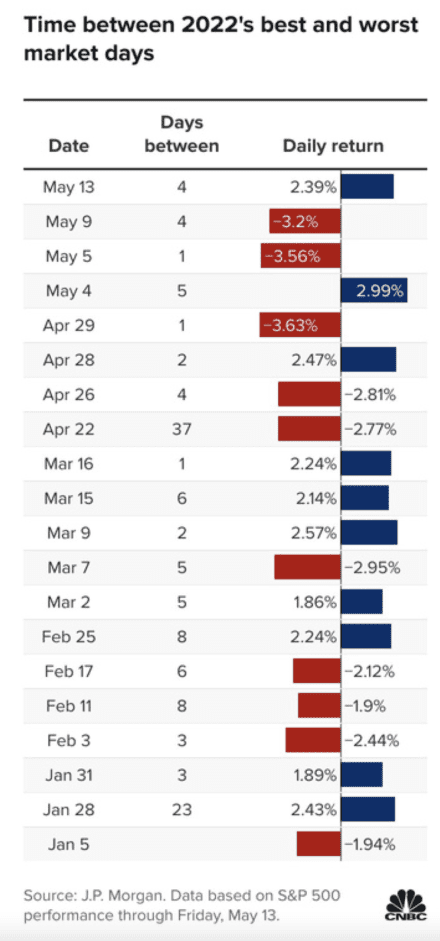

To illustrate, higher-than-average volatility has seen the markets fluctuate for much of the year. Many of the worst days for the S&P 500 Index in the first six months of the year were followed closely by many of its best days, as evidenced by the accompanying graphic.

What lessons can we learn from this data? In the immortal words of Winston Churchill, “If you’re going through hell, keep going.” Be wary of acting reactively because when the markets take a hit, they may already be poised for a comeback. While past results are no guarantee of future performance, this historical perspective might provide some comfort to investors when stock prices are tumbling.

The relative peaks and troughs were separated by an average of 6.7 days, with a handful of turnarounds happening in as quickly as one day. This demonstrates the importance of exercising discipline over the course of your investing journey. It isn’t always easy to maintain an even keel—particularly when the markets are going through a rough patch—but avoiding panic-induced selling in the near term can pay off in the long run.

Time, not Timing, is Your Friend

When it comes to growing wealth, your investment time horizon may end up being far more impactful than your ability to finesse the markets. Instead of overanalyzing your holdings and trying to forecast highs or lows—which can be stressful, time-consuming, and risky—think about staying invested for a full market cycle. That means acquiring assets you intend to hold onto for the foreseeable future and actually holding onto them, barring any significant developments that diminish their long-term efficacy.

In the midst of so much volatility and facing an uncertain future, there are a lot of questions we don’t know the answers to. How bad will the markets get before things turn around? How long will this downturn last? And when will the full extent of slowed economic growth become apparent? What we do know, though, is that every other time the market has declined, it’s rebounded to new heights within a handful of years.

To illustrate the value of staying invested over an extended period, if you had invested $1000 in an S&P 500 fund back in 2002 and reinvested your dividends along the way, your investment could be worth as much as $4,934 today. That’s nearly a 400% return over a 20-year period. If you’d made the same upfront investment in 1992, it could be worth as much as $16,506 today—that’s a 1550% return over 30 years.

The Takeaway

Although there’s no guarantee that the US economy will continue to expand at quite the same rate that it has historically, an analysis of past market performances reveals a pattern of consistent growth that investors of all shapes and sizes can take advantage of.

Rather than asking yourself or your advisor, “how might these investments benefit me in a year?” consider asking, “how might these investments benefit me in 20, 30, or even 40 years?” Always try to view your investments through the lens of your long-term goals. Thinking in terms of decades instead of months or weeks may help you stay the course, even when the markets are at their worst.

Interested in hearing more on this topic? Your financial professional can help you better understand market cycles and trends so that you can feel more confident in your investment decisions.